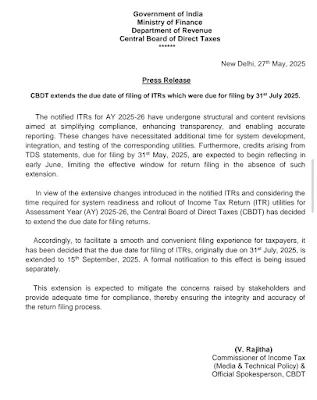

The Central Board of Direct Taxes (CBDT) extended the due date for filing income tax return (ITR) to September 15, 2025, originally it was due on July 31, 2025 for the FY 2024-25 (AY 2025-26) in India. It means assessees can file the ITR within September 15,2025 without incurring penalties and interest.

Belated ITR

If any assessee misses the ITR submitting date they can file a belated return by December 31,2025. However, assessees filing belated ITR is liable to pay penalties and interest.

(Source:https://incometaxindia.gov.in/pages/default.aspx)